Introduction

Table of Contents

Understanding Ausschütter Strategies

Ausschütter strategies, originating from German investment terminology, refer to dividend-focused investment strategies. These strategies emphasize the selection of stocks and assets that provide regular income through dividends. For investors seeking steady income streams and potential long-term growth, Ausschütter strategies can be a powerful tool.

Importance of Dividend Investing

Dividend investing plays a crucial role in building a robust and balanced investment portfolio. By focusing on dividend-yielding stocks, investors can benefit from regular income, potential capital appreciation, and a buffer against market volatility. This approach is particularly appealing to retirees and conservative investors looking for reliable income.

Key Principles of Ausschütter Strategies

Selecting High-Quality Dividend Stocks

The foundation of Ausschütter strategies lies in selecting high-quality dividend stocks. These stocks typically belong to well-established companies with a history of stable and growing dividend payouts. Key metrics to consider include dividend yield, payout ratio, and dividend growth rate.

Diversification

Diversification is essential in mitigating risks associated with individual stocks or sectors. By diversifying across various industries and geographies, investors can achieve a balanced portfolio that reduces exposure to sector-specific risks and enhances overall stability.

Reinvestment of Dividends

Reinvesting dividends is a powerful strategy to maximize returns. By using dividend payouts to purchase additional shares, investors can benefit from compounding, which significantly enhances long-term growth potential.

Monitoring and Adjusting the Portfolio

Regularly monitoring the portfolio and making necessary adjustments is crucial in maintaining the effectiveness of Ausschütter strategies. This includes reviewing company performance, dividend sustainability, and market conditions to ensure the portfolio remains aligned with investment goals.

Benefits of Ausschütter Strategies

Steady Income Stream

One of the primary benefits of Ausschütter strategies is the steady income stream provided by regular dividend payments. This income can be especially valuable for retirees or those seeking supplemental income.

Potential for Long-Term Growth

In addition to providing income, high-quality dividend stocks often offer potential for long-term capital appreciation. Companies that consistently pay and grow dividends tend to have strong financial health and sustainable business models, which can drive stock price growth.

Reduced Volatility

Dividend-paying stocks are generally less volatile than non-dividend-paying stocks. The regular income from dividends can provide a cushion during market downturns, helping to stabilize the portfolio.

Tax Advantages

In many jurisdictions, dividends are taxed at a lower rate compared to other forms of income. This tax advantage can enhance the overall return on investment, making dividend-focused strategies more attractive.

Implementing Ausschütter Strategies

Step-by-Step Guide

1. Define Your Investment Goals

Determine your investment goals, risk tolerance, and time horizon. This will guide your selection of dividend stocks and overall strategy.

2. Research and Select Dividend Stocks

Conduct thorough research to identify high-quality dividend stocks. Look for companies with a strong track record of dividend payments, sustainable earnings, and positive growth prospects.

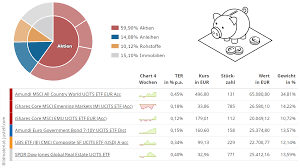

3. Diversify Your Portfolio

Build a diversified portfolio by investing in dividend stocks across different sectors and geographies. This diversification helps mitigate risks and enhances stability.

4. Reinvest Dividends

Opt for a dividend reinvestment plan (DRIP) to automatically reinvest dividends into additional shares of the same stock. This approach leverages the power of compounding to maximize returns.

5. Monitor and Adjust Regularly

Regularly review your portfolio to ensure it remains aligned with your investment goals. Make adjustments as needed based on company performance, market conditions, and changes in your financial situation.

FAQs

What are Ausschütter strategies?

Ausschütter strategies are investment strategies focused on selecting and managing dividend-paying stocks to generate regular income and potential long-term growth.

Who can benefit from Ausschütter strategies?

Ausschütter strategies are suitable for investors seeking steady income, such as retirees, and those looking for a balanced approach to growth and income. They are also ideal for conservative investors aiming to reduce portfolio volatility.

How do I select the best dividend stocks?

Select dividend stocks with a strong history of stable and growing dividends, sustainable earnings, and positive growth prospects. Key metrics to consider include dividend yield, payout ratio, and dividend growth rate.

What is the importance of reinvesting dividends?

Reinvesting dividends enhances returns through compounding. By purchasing additional shares with dividend payouts, investors can significantly boost long-term growth potential.

How often should I review my portfolio?

Regular portfolio reviews, typically on a quarterly or annual basis, are essential to ensure alignment with investment goals and make necessary adjustments based on performance and market conditions.

Conclusion

Harnessing the Power of Dividends

Ausschütter strategies offer a compelling approach to investing, combining the benefits of regular income, potential for long-term growth, and reduced volatility. By focusing on high-quality dividend stocks, diversifying the portfolio, and reinvesting dividends, investors can maximize their profits and achieve financial stability.

Take the First Step

Whether you’re a seasoned investor or just starting, implementing Ausschütter strategies can help you achieve your financial goals. Begin by defining your investment objectives, researching dividend stocks, and building a diversified portfolio to unlock the full potential of dividend investing.