Introduction to Financial Technology (FinTech)

Table of Contents

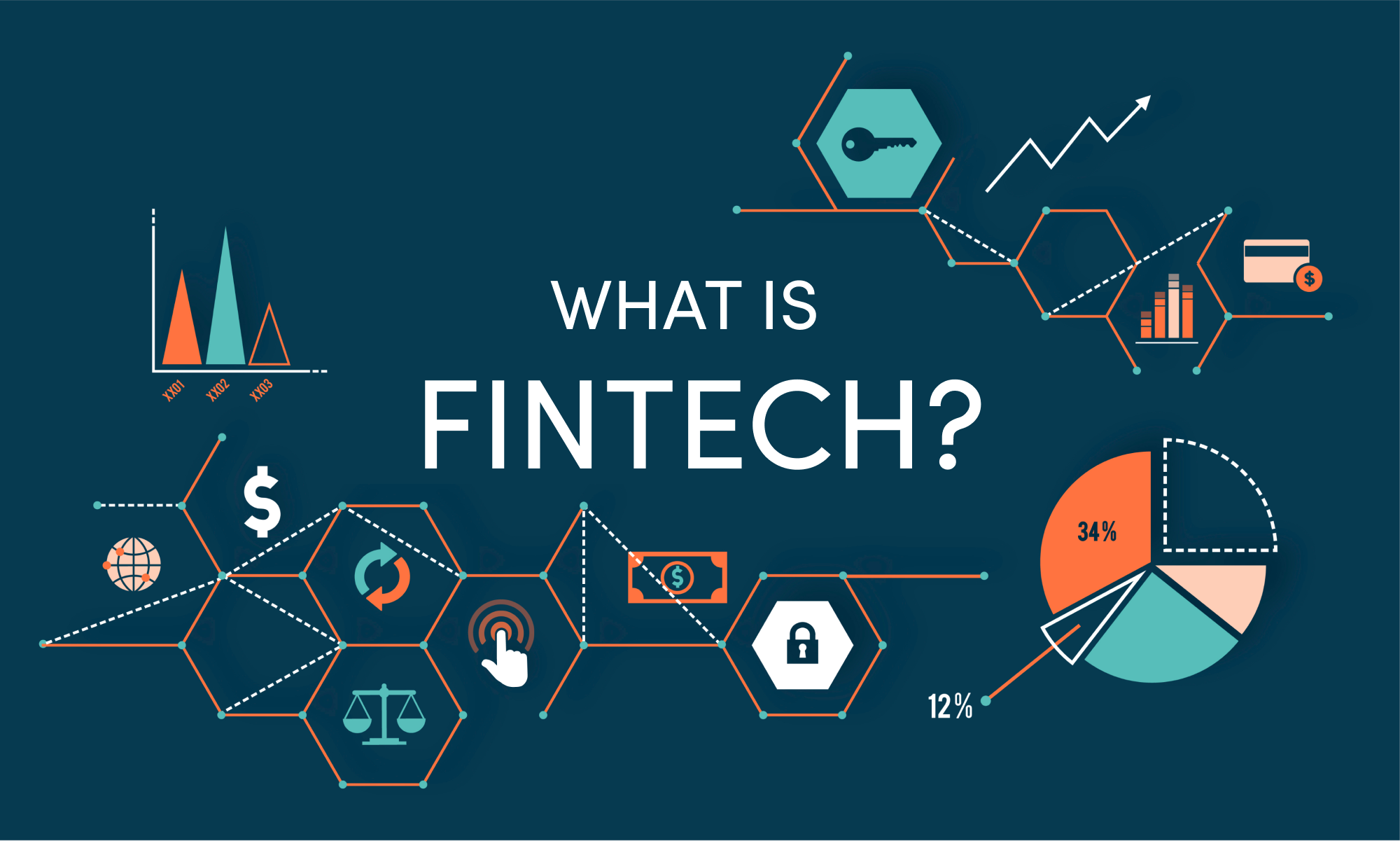

In today’s rapid-paced, technology focused world, financial technology, frequently mentioned as FinTech, has changed into a basis of advanced financial assistance. But what particularly is FinTech, and why is it so important?

FinTech speaks to the integration of innovation with financial services, advertising inventive solutions to age-old issues. It ranges everything from mobile banking apps to progressed artificial insights calculations utilized for investment proposals. Essentially, FinTech is transforming how people and businesses manage their finances.

History of Financial Technology

Early Days of FinTech

Though FinTech might appear like an unused buzzword, its roots follow back to the development of the transmission and the first credit cards. These early advances cleared the way for the advanced time of digital banking.

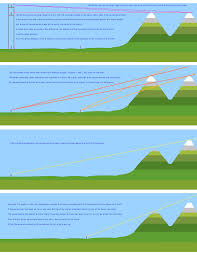

The Evolution of FinTech Through the Decades

The 1990s saw the rise of online managing an account, and with the birth of the web, a more associated world opened the entryway for the innovative solutions we see nowadays. The 2008 worldwide financial crisis pushed indeed more mechanical progressions as individuals requested better, faster, and more transparent financial services.

Key Components of FinTech

Digital Payments

When we think of FinTech, one of the to begin with is digital installments. Services like PayPal, Venmo, and mobile wallets like Apple Pay and Google Pay have sent money through the world time and smoothly.

Blockchain and Cryptocurrencies

Blockchain is the technology underlying cryptography like Bitcoin. By marketing a dispersed record, blockchain gives a secure and transparent way to path interactions without the necessity for traditional mediators, such as banks.

Robo-Advisors and AI-Driven Services

AI-powered tools like robo-advisors are making conjecture management available to everybody. These services utilize calculations to make personalized investment portfolios, taking the guesswork out of overseeing finances.

Benefits of Financial Technology

Financial innovation, driven by computer technology, offers noteworthy benefits. It progresses productivity, brings down costs, and upgrades to financial administrations. With superior security and quicker exchanges, it simplifies errands like installments, speculations, and keeping money, making financial management less demanding and more open for everyone.

Convenience and Accessibility

FinTech makes keeping money available from any place, at any time. You no longer have to hold up in long lines at the bank or stress almost inconvenient working hours.

Efficiency in Financial Services

FinTech reduces the time it takes to total financial exchanges. Whether you’re applying for credit, exchanging cash, or contributing, everything can be done in a division of the time compared to conventional methods.

Cost Reduction

FinTech companies are regularly more reasonable than their conventional partners. Peer-to-peer loaning stages, for instance, regularly offer lower intrigued rates than conventional banks.

Challenges in Financial Technology

Challenges in financial technology, fueled by digital technology, incorporate cybersecurity dangers, administrative complexities, and client selection issues. As digital technology propels, guaranteeing information protection and security gets to be significant. Furthermore, exploring directions and picking up clients pose critical hurdles for FinTech companies worldwide.

Cybersecurity and Privacy Risks

As more financial exchanges are put online, the chance of cyber-attacks increases. FinTech companies must continually remain ahead of programmers and guarantee that their users’ information is secure.

Regulatory Hurdles

With fast development comes the challenge of keeping up with directions. FinTech companies must explore complex lawful scenes, which change from nation to country.

Technical Issues and User Adoption

While FinTech offers extraordinary tools, specialized glitches, and client selection challenges can prevent its development. Not everybody is tech-savvy, and building a belief with modern clients is a critical challenge.

How FinTech is Changing Traditional Banking

FinTech, leveraging digital innovation, is changing conventional managing an account by advertising quicker, more effective services. Mobile keeping money, online payments, and computerized credits have supplanted physical branches. FinTech disentangles financial errands, reduces costs, and improves client experiences, making conventional managing an account more available and helpful for everyone.

Popular FinTech Services and Applications

Popular FinTech administrations and technology applications incorporate mobile wallets, peer-to-peer lending stages, and robo-advisors. These innovation applications streamline installments, give moment credits, and offer mechanized investment administration. They simplify money-related assignments, making administrations more available, effective, and user-friendly in today’s digital-driven world.

Cryptocurrency: The FinTech Revolution

Cryptocurrency, a key portion of the FinTech revolution, is reshaping technology commerce administration. It offers decentralized financial exchanges, lessening the requirements for conventional middle people. With blockchain innovation, cryptocurrencies give secure, transparent arrangements, changing how businesses oversee and conduct financial operations in the computerized economy.

Read Also: New Future Technology Trends: A Glimpse Into Tomorrow’s Innovations

Read Also: What is Engineering Technology?